|

TCFD Recommendation

- Describe the climate related risks and opportunities the organization has identified over the short, mid and long term

NSG Group Approach

The Group has carried out an analysis of the risks and opportunities associated with climate change in the short (1 - 2 years), medium (2 - 4 years) and long term (5 years, usually up to 15 years) according to the following three main scenarios to identify physical and transition risks in the timescale to 2100

- Low Carbon World (<2°C) – A scenario in which aggressive mitigation measures are taken to curb carbon emissions over the next 30 years with the aim of transitioning to a low-carbon economy.

- RCP 4.5 Medium stabilization scenario (2-3°C temperature rise) – Interim scenario, assuming that current policies, pledges and targets are achieved.

- RCP 8.5 High reference scenario (>4°C) – A scenario in which global temperatures continue to rise substantially, with catastrophic consequences, as a result of continued emissions growth with little or no measures to avoid physical risks.

Further description of some of these aspects and others regarding physical risk analysis outcome is given below;

- Current regulation - e.g. European Energy Directive - opportunity in supplying high performance products associated with the directive Emerging regulation, e.g. new industrial Emissions Trading Schemes (ETS) leading to risk of increased operational costs. New EU building ETS leading to opportunities to supply high performance energy saving products.

- Technology development - e.g. EV market growth, low energy buildings market growth.

- Legal compliance - risk & cost of meeting future compliance, opportunities associated with more stringent product demands and NSG competitive product development.

- Market aspects - e.g. customer specifications for building / vehicle efficiency with associated opportunities for product development

- Reputation - e.g. risk associated with customer or other stakeholder perceptions.

- Acute Physical - e.g. flood, typhoon risk impact to operations & value chain (supply continuity) opportunity for specific product development e.g. storm glazing.

- Chronic Physical - e.g. sea level rise primarily risk impact to current and future operations and value chain.

Risks & opportunities identified were quantified and categorised according to the NSG Group standard risk management framework and prioritised accordingly. They include impacts from; Policy & legal aspects, Technology aspects, Market aspects and Reputational aspects. A review of these aspects was conducted during the reporting year to ensure the strategy continues to be relevant. Additional legislation e.g. CSRD and stakeholder aspects, e.g. Biodiversity, circularity, community impact is being used for developing the new NSG Group medium term plan.

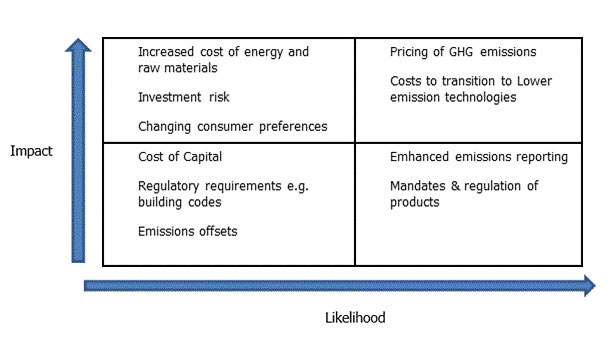

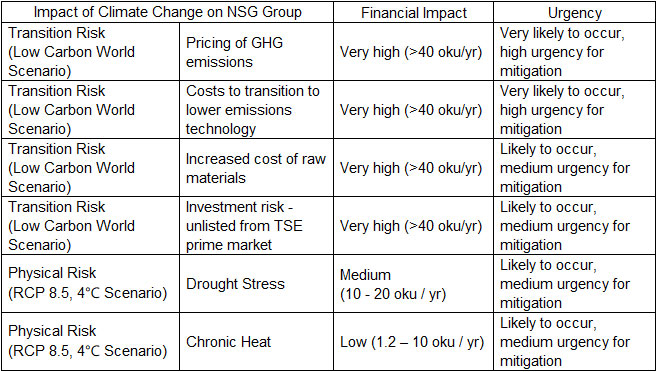

Assessed Range of annual impact and likelihood of transition risks – residual risk on Long term horizon (2035) under a Low Carbon World scenario:

■Examples of risks with heavy impact or high urgency

Further Disclosure / Information sources

CDP report 2023 C2.1 - 2.4

|

|

TCFD Recommendation

- Describe the impact of climate related risks and opportunities on the organizations business strategy and financial planning

NSG Group Approach

- NSG Group business strategy already incorporated the risks and opportunities identified from the 2019/20 materiality assessment and the scenario analysis. This was enhanced within the RP24 and the inclusion of various aspects of the climate scenario analysis activity completed in 2021/22.

- Further development in 2022 including the initial review of existing aspects alongside new aspects to redefine materiality level. This analysis forms a key part of the new medium term plan strategy.

- Examples of key initiatives regarding mitigation of climate impacts and maximising opportunity include;

- Working with supply chain and value chain partners to establish win-win scenarios for product development supporting the low carbon transition. This includes the launch of a specific project in 2021/22 titled 'Sustainable Supply Chain' which will focus on various sustainability aspects including CO2* emissions in the supply chain.

- Investment in R&D technology developments to reduce operational GHG emissions

- Development of new products to support society decarbonization and achievement of national decarbonization targets, e.g. net zero 2050 ambition.

- Such activities match precisely to the NSG Group mission of 'Changing our surroundings, improving our world'.

- * Because >99.9% of our GHG emissions are CO2, thereafter we only mention CO2

Further Disclosure / Information sources

https://www.nsg.com/en/investors/management-policy-and-sustainability/management-strategy

https://www.nsg.com/en/investors/management-policy-and-sustainability/materiality

https://www.nsg.com/sustainability/ceo

https://www.nsg.com/en/sustainability/sustainability-of-nsg-group/climate-change/va-products-and-services

|

|

TCFD Recommendation

- Describe the resilience of the organization strategy, taking into consideration different climate related scenarios including a 2°C or lower scenario

NSG Group Approach

- As previously described, NSG undertook a quantitative and qualitative analysis of climate resilience based on several warming scenarios in 2021/22. A key output from this study was understanding the resilience associated with the existing mitigation measures that were already embedded into the Group strategy and developing a prioritised list of actions to undertake moving forwards.

- One key output from this analysis has been the development and implementation of mid and long term decarbonization targets for the Group given that the highest impact and likelihood aspect was the increased costs associated with pricing of GHG emissions. The NSG Group established a verified SBT in 2019 which has been replaced in May 2022 with a target based on an increased level of ambition, utilising a well below 2°C warming scenario.

- Adherence to this target will improve the resilience of the Group to climate related risks from both physical and transitional impacts.

Further Disclosure / Information sources

CDP report 2023 C3.1 - 3.5

|