Recognition of Operating Profit (Exceptional Items) and Comparison of Actual Results and Previous Forecast Results

1. Recognition of Operating Profit (Exceptional Items)

(1) The background and rationale

The NSG Group (the Group) has recognized an exceptional gain on the reclassification of its investment in Shanghai Yaohua Pilkington Glass Group Co., Ltd. (“SYP”). The Group owns a shareholding in SYP of 15.18 percent. Previously the Group has carried this investment in its balance sheet as an affiliated company using the equity method of accounting. Following a decrease in the level of the Group’s management involvement with SYP, the Group is no longer able to exert a significant influence over SYP. IAS 28 “Investments in Associates and Joint Ventures” contains a rebuttable presumption that a shareholding of less than 20 percent does not enable an investor to exert significant influence over an investee. Previously the Group has been able to rebut this presumption due to the level of its management involvement with SYP. As a consequence of this change, the Group is no longer able to rebut this presumption in IAS 28. The Group is therefore required to record its investment in SYP at fair value, and reclassify it as an available-for-sale asset on the Group’s balance sheet.

(2) The outline of the recognition

As a result of the revaluation to fair value of the Group’s shareholding in SYP for the purpose of the aforementioned change, the Group has recognized the following revaluation gain in its consolidated accounts. As a consequence of this gain, the result for the half-year to 30 September 2014 differs from the previous forecast as mentioned in item.2 below:

- Amount of the gain: JPY 13.3billion (an exceptional item in the operating profit)

- Timing of recognition: at the second quarter of the financial year to 31 March 2015

(3) Outlook

At present, no revision of the forecast for the financial year to 31 March 2015, which was issued originally on 15 May 2014, is planned following the recognition of this profit. If any revision becomes necessary based upon a comprehensive consideration on the Group’s business aspects, it will be announced immediately.

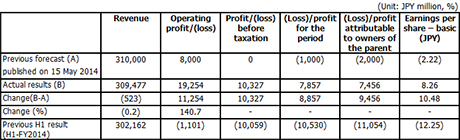

2. Comparison of actual results and previous forecast results

Operating profit, profit before taxation, profit for the period and profit attributable to owners of the parent for the half-year to 30 September 2014 differs from the previous forecast, originally issued on 15 May 2014, as set out below.

(1) Comparison of actual results and previous forecast results

(2) Reason for the difference

Operating profit is higher than previously forecast due to a higher level of credits within exceptional items than had been expected. The exceptional credits arise on the reclassification of Group’s interests in SYP Glass Group Co., Ltd (SYP), as mentioned above in item.1, and also on the sale and lease-back of the Group’s property at Itami City, Hyogo Prefecture, Japan, as announced on 26 September 2014. Partly offsetting the above mentioned gains, trading profits were below original expectations, particularly in the Automotive business line in South America, which has suffered from lower volumes than previously expected.

Profit before taxation and profit for the period are both higher than previously expected as a consequence of the higher operating profit as described above.

ends